OUR INNOVATIVE LEARNING SOLUTIONS

Accelerate business growth

1. BANKING SIMULATIONS

Add a new line of business

Since 1999 we have been designing banking simulations specifically for developing awareness among professionals and students within the banking, consulting and finance sector.

2. BANKING GAMES

Serious play

Our business games are designed to assist professionals with the advancement of their careers via continuing education. By offering a flexible learning platform, professionals and students can learn in their own time and at their own pace.

3. CUSTOM SOLUTIONS

Build your own

With over 200 variable parameters in each banking simulation, the local regulatory environment as well as country macroeconomic and market conditions can be customized. In addition to this, we can use the latest financial results of a bank as a starting position for a specific training session.

How our simulations are used

Our simulations are flexible and engaging

Used around the globe by

ALM professionals, Treasury Professionals, Risk Managers, Project Managers from Consulting Firms , Chief Financial Officers , Support Staff in IT/HR/Marketing, Students in Graduate Development Programs ,

What makes us different?

Flexible Design

Our simulations and tools have been designed to easily adapt to the specific requirements of a bank. With over 200 variable parameters, our simulations can replicate a bank of any size, local regulatory environment as well as local economic and market conditions.

Flexible Delivery

and Facilitation Options

Because each client’s needs are unique, our simulations are designed to be used as part of a training program, as a stand-alone workshop, as an e-learning course or personal development tool.

Technology Driven

Our simulations are in the cloud thus no downloading is required. They are available online on a 24/7 basis and support multiple browsers and devices.

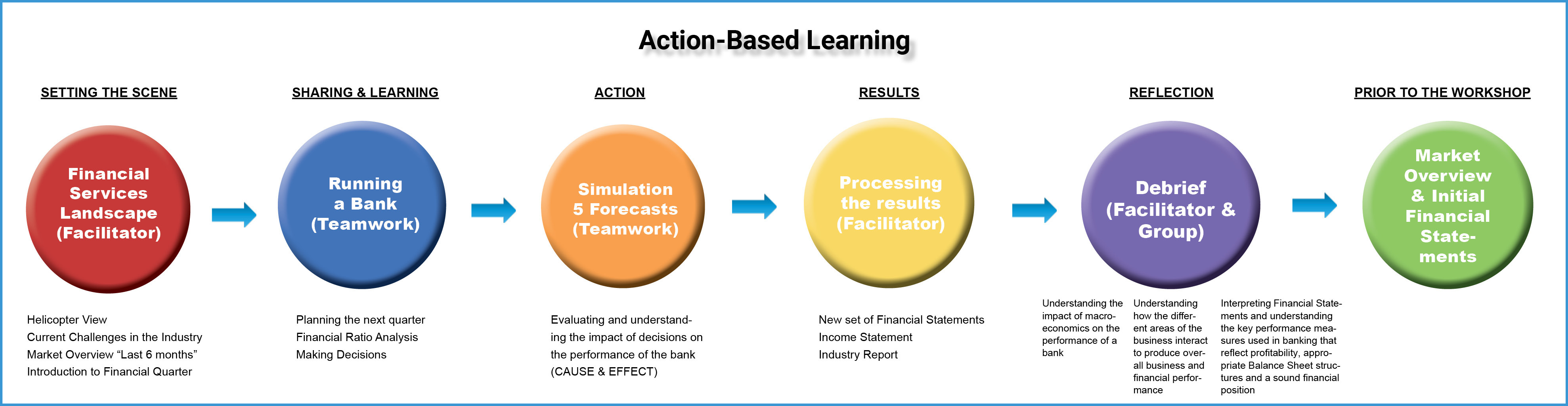

Methodology

Action-Based Learning

Through action-based learning via our simulation programs, we ensure the accelerated transfer of financial know-how and development of essential skills in finance and banking.

What our clients have to say

RABOBANK

Young Professionals Program

“Insights into the mechanisms in the bank, the challenges and how to deal with them.” The Netherlands

RABOBANK

Young Professionals Program

“Much better understanding of the Balance Sheet and P&L and the impact of decisions on these.” The Netherlands

RABOBANK

Young Professionals Program

“Managing capital and liquidity is crucial and more important than short term profits.” The Netherlands

BANKSETA

Learnership Program – National Certificate in Banking

“Banks are the cogs of the economy, and government relies heavily on them in the running of the country.” South Africa

BANKSETA

Learnership Program – National Certificate in Banking

“One of the highlights of our training was being in charge of a bank and getting an overview of how banks operate.” South Africa

BANKSETA

Learnership Program – National Certificate in Banking

“It was fun working in a team. It showed us the importance of joint decision making and using various strategies to get best results.” South Africa

EY

Risk Management Training conducted by SimArch & 3Masters

The training provided a broader view on banking and enables me to advise clients better in the future. Advisor/ Consultant - Financial Services, EY Amsterdam

Erste Bank

Bank Management Training

I enjoyed this in-depth training very much, it was massive on the content side for an IT person (like me) – but great learning curve. I believe I have learned more about banking (high level and in general) than in many other years and trainings combined – thanks a lot for this great opportunity and your hands-on approach. IT Professional, Erste Bank Austria

Chase Bank

Asset & Liability Management

As I went through the 3 day ALM training by Simarch, what struck me most was its ability to combine the complex and multi-faceted aspects of Capital, Liquidity and Risk into simple, practical and achievable steps. What would otherwise have been ‘dreary’ topics morphed into fun, engaging and thought-provoking debates among participants. The unique role we all contribute towards the Bank’s balance sheet was an aha! for many of us. All this plus a touch of fun and wit from our facilitator Andrew made this one of the most remarkable trainings I ever attended! I would definitely recommend it to any banker anywhere! Senior Manager, Corporate Sales Chase Bank

ABSA Bank

Balance Sheet Management Training Program

Highly interactive course! I gained a greater understanding of liquidity ratio’s and its impact on the balance sheet as well as the key management variables in banking. Johannesburg, South Africa

Royal Bank of Scotland

Asset & Liability Management

The simulation is an excellent tool for exploring risks associated with ALM and the training offers a good balance between course work and simulation. London, United Kingdom

KBC Bank

Fundamentals of Bank Management

Great course! We were provided with great insight using real life examples. It gives a really good overview and insight into bank strategy, to know how different areas are interconnected.Very good to practice with the simulation. A very good course to broaden your view. KBC Brussels, Belgium